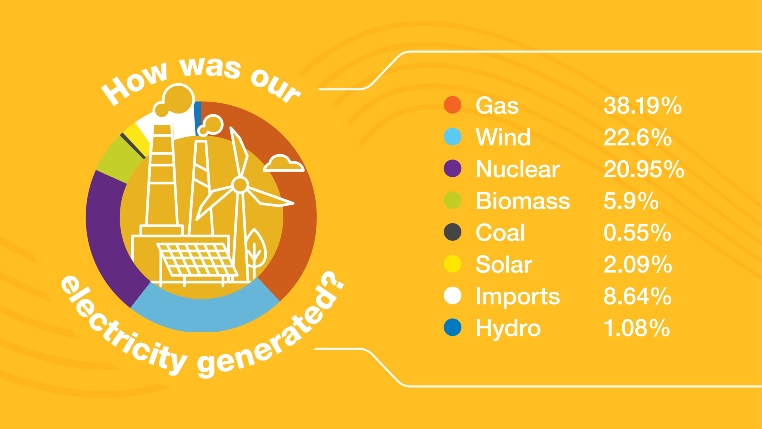

Our Energy Mix

The GB National Grid is powered by a mixture of sources, from coal through to renewables. Looking at the October 2020 results, 47% of our generation came from zero-carbon sources. That seems good, right? I think so. But as you dive into the numbers behind the remaining 53% it’s mostly gas which we want to avoid. And, thankfully coal is less than 1% – we really want to avoid using coal!

The Good, The Bad And The Ugly

You’re with me on the concept that renewables are good, gas bad and coal is ugly, I presume.

So how about this?

Since coal is the first energy source we’d choose to turn off, it can be thought of as the final source of energy we are choosing to use. If we decide to switch on one more light in the house, it’s likely that at best we’re using gas and at worst coal.

Shall I put that another way? If all the good renewable energy is being used already, then to make a further demand on the grid will mean gas or coal has to be used.

Whilst we can’t control the wind and clouds or the journey of the Earth around the sun, we are not completely without influence. We can turn off lights as we leave rooms, we can run appliances overnight or at weekends when the demand on the grid is lower etc.

And if we make those changes, those adjustments in our behaviour, it results in less coal and less gas being burned to power our lives.

How Does this Relate To Tax?

Well, each year as a business owner, you have a need for income to fuel your lifestyle. And as you’re all too aware, you pay tax on that income. The tax is worked out through various bandings.

- the tax-free bit – think of this as our solar/wind/hydro heroes

- the fairly cheap basic rate bit – think nuclear, not ideal but ‘ok then’

- the more costly higher rate bit – it’s gas,. If you want the lifestyle ‘stuff’ then it comes at a cost

- the secret 60% tax rate bit – coal, you just want to avoid it, right?

To avoid overpaying tax, conscious choices need to be made IN ADVANCE about what income to draw and when and how to draw it.

Isn’t Tax Avoidance Wrong?

No. Well yes. The ‘Tax Avoidance’ you hear about in the media where celebrities are caught out using a ‘tax avoidance scheme’ or some giant multinational finds that all of their global profits miraculously and legally (!) arise in some tiny tax haven – clearly massively wrong.

A business owner, however, is routinely exposed to volatility in their income in a way that only a tiny minority of PAYE employees will ever experience. One year they could be ploughing everything back into the business, the next they could be trying to finally get on the housing ladder – not as easy without payslips.

With a smart tax advisor, a solid financial system providing in-year clarity and an ongoing dialogue around aims and objectives, taxes and incomes can be planned in the right way.

Tax Planning Sounds Dodgy

The reality is that tax havens and exotic tax avoidance schemes are the preserve of the wealthy. And yes, legal or not, I consider them to morally dodgy. My belief is that tax is a by-product of getting it right, of doing well, of growing profits, jobs and incomes so let’s do that.

In running the national Grid, it would be negligent to stand down some wind turbines in the morning only to burn coal in the afternoon. They in fact plan for expected demand and supply and do it well.

The same goes for tax planning. By looking ahead and assessing what’s needed, a business owner can optimise their tax.

Why fail to use all of the cheaper, Basic Rate band one year (nuclear), only to fall into the secret 60% band the next (coal)?

Why fall into the secret 60% band (coal) at all when you can defer the income or add more to a pension pot?

What Does Good Look Like?

Traditionally, our profession would grab your bank statements, do some sums and tell you what you owe HMRC. And all too often it happened painfully close to the payment deadline.

Now though, with tools like Xero at our fingertips, we can be much smarter and more deliberate in the tax planning. It’s not just about setting a low salary and the rest as a dividend, it’s about ironing out the volatility, optimising over multiple years and balancing income with life goals.

Is it tax avoidance? No. But the objective is to pay not a single pound more in tax than you need to.